Get Help With Your Essay. Of Stocks that are in still loss if held for 10yrs. Yumda- Coca-Cola Zero Sugar refreshes taste and look. Historically Coca-Colas dividend payouts have been over 50 of the net income of any given period. Current ratio shows the business ability to cover the short term debt As it shows in the graph Coca Cola company recorded a current ratio of 128 in 2016 and having a current ratio above. For complete information regarding our financials. Buying a low-cost index fund will get you the average market return. Coca-Cola Company KO Dividends 2007-2010. Fortunately in 2019 the organizations revenues would grow by approximately 8 ending the year at 372 billion. Coca-Cola Company KO stock performance 2007-2009 The share price of Coca-Cola Corp declined from 3278 to 1893 during the 2007-2009 financial crisis declining by 422 MDD which is a good performance during this period.

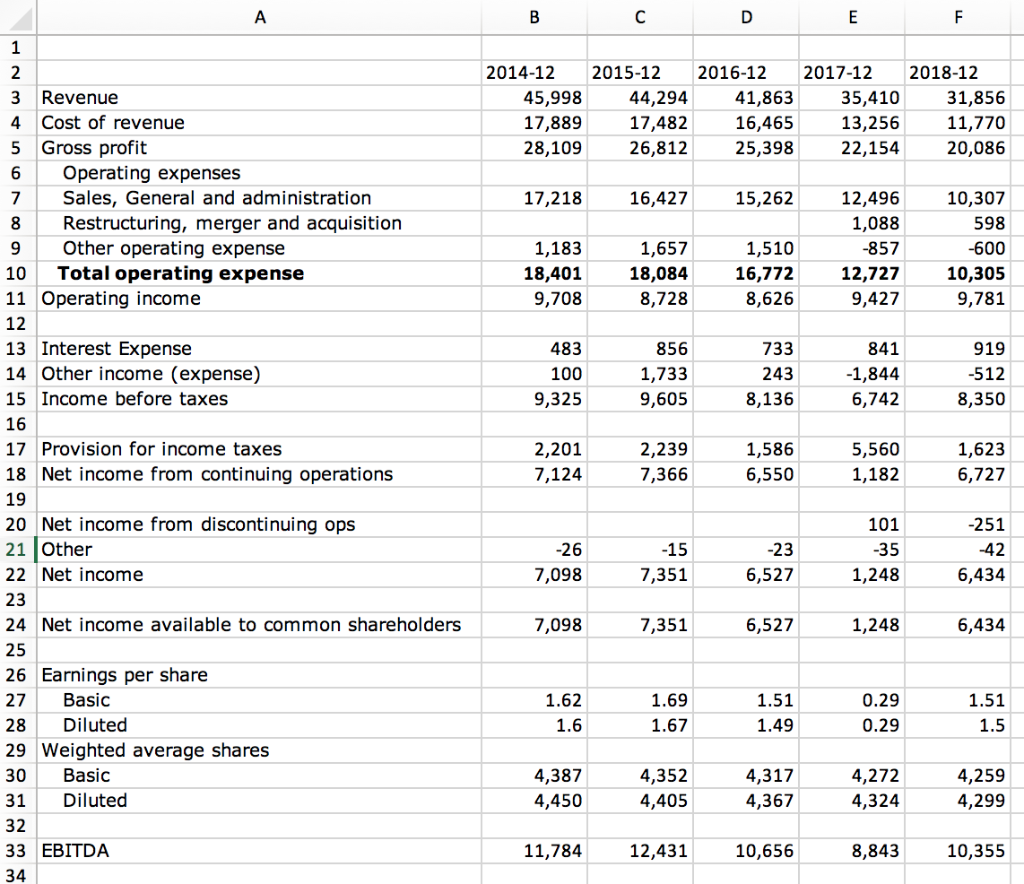

Coca-Cola Company KO stock performance 2007-2009 The share price of Coca-Cola Corp declined from 3278 to 1893 during the 2007-2009 financial crisis declining by 422 MDD which is a good performance during this period. During a period from transactions and other events and circumstances from non-owners sources. The income statement statement of earnings reports on the performance of Coca-Cola Co the result of its operating activities. Historically Coca-Colas dividend payouts have been over 50 of the net income of any given period. Statement of Comprehensive Income Comprehensive income is the change in equity net assets of Coca-Cola Co. 1-Star Back Testing Results. Current ratio shows the business ability to cover the short term debt As it shows in the graph Coca Cola company recorded a current ratio of 128 in 2016 and having a current ratio above. It is observed that Coca-Colas debt-financing strategy justifies the reasons for maintaining high debt-to-assets and debt-to equity ratios. Fortunately in 2019 the organizations revenues would grow by approximately 8 ending the year at 372 billion. Quote Stock Analysis News Price vs Fair Value Sustainability Trailing Returns Financials Valuation Operating Performance.

For that reason in comparison with all businesses the Company has a higher result. Organic Revenues Non-GAAP Declined 3 for the Quarter and 9 for the Full Year. Yumda- Coca-Cola Zero Sugar refreshes taste and look. Buying a low-cost index fund will get you the average market return. Board of Directors Elects Corporate Officer and Declares Regular Quarterly. But in any diversified portfolio of stocks. It is observed that Coca-Colas debt-financing strategy justifies the reasons for maintaining high debt-to-assets and debt-to equity ratios. Comparable Operating Margin Non-GAAP Was 310 Versus 307 in the Prior Year. Get Help With Your Essay. Comparable EPS Non-GAAP Grew 8 to 055.

Fortunately in 2019 the organizations revenues would grow by approximately 8 ending the year at 372 billion. It is observed that Coca-Colas debt-financing strategy justifies the reasons for maintaining high debt-to-assets and debt-to equity ratios. View full release as PDF February 10 2021 655am EST. During a period from transactions and other events and circumstances from non-owners sources. Coca-Cola Company KO stock performance 2007-2009 The share price of Coca-Cola Corp declined from 3278 to 1893 during the 2007-2009 financial crisis declining by 422 MDD which is a good performance during this period. Quote Stock Analysis News Price vs Fair Value Sustainability Trailing Returns Financials Valuation Operating Performance. Rating as of Jul 13 2021. Statement of Comprehensive Income Comprehensive income is the change in equity net assets of Coca-Cola Co. CocaCola Financial Ratios for Analysis 2005-2021 KO. C Revenue Outlook.

Rating as of Jul 13 2021. Yumda- Coca-Cola Zero Sugar refreshes taste and look. For that reason in comparison with all businesses the Company has a higher result. 1-Star Back Testing Results. Get Help With Your Essay. Current ratio shows the business ability to cover the short term debt As it shows in the graph Coca Cola company recorded a current ratio of 128 in 2016 and having a current ratio above. Organic Revenues Non-GAAP Declined 3 for the Quarter and 9 for the Full Year. Coca-Cola Reports Fourth Quarter and Full Year 2020 Results. In the next two years the organizations revenues would drop considerably ending 2018 at 343 billion. For the full year revenue is expected to increase by 93 from 319 billion in 2018 to 348 billion in 2019 and further by 47 to 365 billion in 2020.