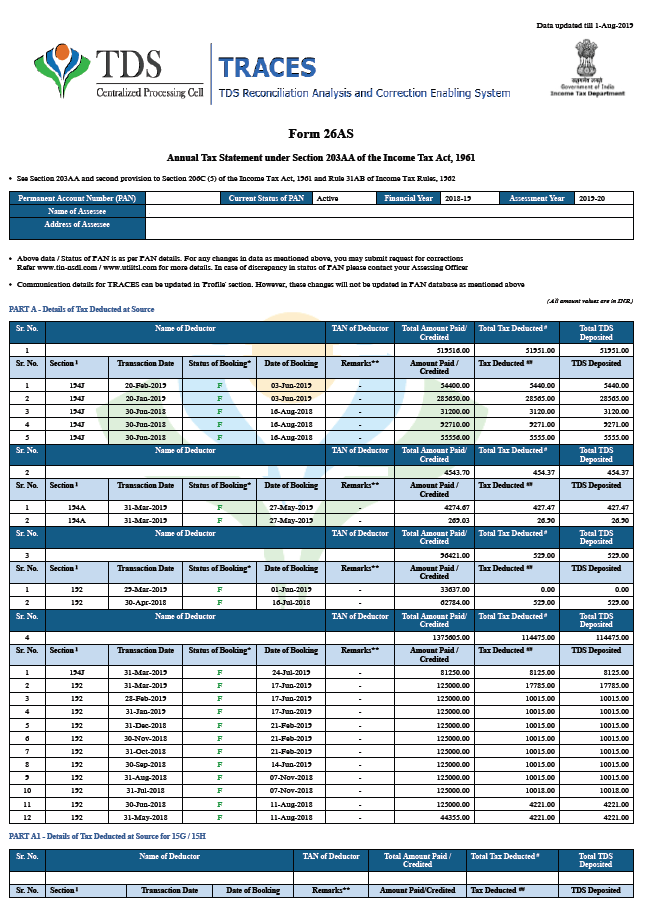

Information relating to tax deducted or collected at source 2. To download the form 26AS in PDF format view in HTML and then click on the Export as PDF button. What is Form 26AS. Once Form 26AS opens in the webpage then you can click on export to PDF and export Form 26AS in PDF format and your download procedure for Form 26AS will end there. XXXX XX Assessment Year. Getty Images To download Form 26AS in PDF format select HTML and click on viewdownload then click on Export as PDF tab. Taxpayers can view download form 26AS through net banking of any of the authorized banks. Once Form 26AS opens in the webpage then you can click on export to PDF and export Form 26AS in PDF format and your download procedure for Form 26AS will end there. Taxpayer can download Form 26AS through TRACES from Assessment Year 2009-10. There are 3 formats of the form 26AS HTML Text and PDF.

Taxpayers can view download form 26AS through net banking of any of the authorized banks. Taxpayer can download Form 26AS through TRACES from Assessment Year 2009-10. Deductee has to place the download request and need to convert it into excel. Hyperlink of View Form 26AS and then select your Assessment year and set mode to HTML. Data updated till 21-Jul-2018 Form 26AS Annual Tax Statement under Section 203AA of the Income Tax Act 1961 See Section 203AA and second provision to Section 206C 5 of the Income Tax Act 1961 and Rule 31AB of Income Tax Rules 1962 Permanent Account Number PAN GYCPS3989A Current Status of PAN Active Financial Year 2017-18 Assessment Year 2018-19 Name of Assessee. Form 26AS is a consolidated annual tax statement that shows the details of tax deducted at source tax collected at source advance tax paid by the assessee along with self-assessment tax. A PDF file of the Form 26AS will be downloaded to your computer. Choose the Assessment Year. XXXX-XX Part-A Permanent Account Number Aadhaar Number Name. Getty Images To download Form 26AS in PDF format select HTML and click on viewdownload then click on Export as PDF tab.

XXXX-XX Part-A Permanent Account Number Aadhaar Number Name. If you want to see Tax details online keep the format as HTML. Form 26AS can be viewed only if the PAN is mapped to that particular account. XXXX XX Assessment Year. Description 3 Part A2 Deductor Upto 26AS of FY 2018-19 AY 2019-20 Details of Tax Deducted at Source on Sale of Immovable Property us 194IA TDS on Rent of Property us 194IB For SellerLandlord of Property For 26AS of FY 2019-20 AY 2020-21. Deductee has to place the download request and need to convert it into excel. How to download for. Form 26AS is an annual consolidated tax credit statement that taxpayers can access view or download from the income tax departments e-filing website. NOTE- Password to open for Form 26AS in PDFText Format is Date of Birth of Taxpayer in DDMMYYYY format. 26AS for Form 15G15H includes transactions for which declaration under section 197A has been Quoted.

26AS is available to view Online in HTML format. Form 26AS is an annual statement which includes all the details pertaining to the tax deducted at source TDS information regarding the tax collected by your collectors the advance tax you have paid self-assessment tax payments information regarding the refund you have received over the course of a financial year regular assessment tax that you have deposited and. How to download latest form 26as2. 26AS is available to download in two formats. How to download form 26as in pdf form3. A PDF file of the Form 26AS will be downloaded to your computer. Go to the My Account menu click View Form 26AS Tax Credit link. Deductee has to place the download request and need to convert it into excel. The form also shows details of salepurchase of immovable property mutual funds cash. 26AS can be viewed by Net Banking or by logging in at Incometaxindiaefilinggovin website which redirects user to TRACES If E-filing website.

Form 26AS is an annual consolidated tax credit statement that taxpayers can access view or download from the income tax departments e-filing website. Select Download as PDF. XXXX XX Assessment Year. How to download for. XXXX-XX Part-A Permanent Account Number Aadhaar Number Name. Description 3 Part A2 Deductor Upto 26AS of FY 2018-19 AY 2019-20 Details of Tax Deducted at Source on Sale of Immovable Property us 194IA TDS on Rent of Property us 194IB For SellerLandlord of Property For 26AS of FY 2019-20 AY 2020-21. 26AS is available to download in two formats. Once Form 26AS opens in the webpage then you can click on export to PDF and export Form 26AS in PDF format and your download procedure for Form 26AS will end there. Once Form 26AS opens in the webpage then you can click on export to PDF and export Form 26AS in PDF format and your download procedure for Form 26AS will end there. Information relating to tax deducted or collected at source 2.