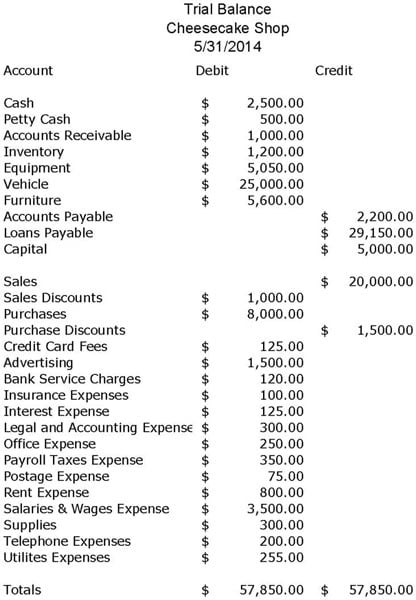

Initial balances per general ledger. In Trial balance all the ledger balances are posted either on the debit side or credit side of the statement. According to Investopedia it is an in-house report usually in the form of a spreadsheet generated at the end of every accounting period. Trial balance is the records of the entitys closing ledgers for a specific period of time. Normally the entity records its daily business transactions in general ledgers. The total of all initial balance debits should. The total dollar amount of the debits and credits. Purpose of a Trial Balance To check the arithmetical accuracy of the transactions and the ledger accounts. The purpose of a trial balance in accounting is to help a business correct inaccuracies before the information is transferred to a financial statement. Trial balance plays an essential tool in checking the arithmetical accuracy of posting ledger accounts assisting the accountant in preparing the financial statements proceeding with audit adjustments etc.

The main purpose of a trial balance is to ensure that the list of credit and debit entries in a general ledger are mathematically correct. The trial balance is recorded under debit and credit columns while a balance sheet ideally displays total assets liabilities and stockholders equity. The main aim of preparing a trial balance is to ensure that the bookkeeping system is mathematically correct. Prior to preparing the final accounts at the end of an accounting period a trial balance is prepared to detect arithmetical errors. The general purpose of producing a trial balance is to ensure the entries in a companys bookkeeping. One of the main objectives of the trial balance is to ensure that the total of. The two also differ in the types of accounts that they display. A trial balance is prepared to check the mathematicalarithmetic accuracy of accounting. A trial balance is like a bookkeeping worksheet the company prepares at the end of the financial year. Initial balances per general ledger.

Since it is anyhow prepared for a purpose it is put to some other uses like being used in the preparation of final accounts etc. The zero items are not usually included. The total of debit balance in trial balance should match with a. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. The two also differ in the types of accounts that they display. What is the Purpose of a Trial Balance. The main purpose of a trial balance is to. In Trial balance all the ledger balances are posted either on the debit side or credit side of the statement. Normally the entity records its daily business transactions in general ledgers. The general purpose of producing a trial balance is to ensure the entries in a companys bookkeeping.

A trial balance is prepared to check the mathematicalarithmetic accuracy of accounting. The purpose of a trial balance is to ensure that all entries made into an organizations general ledger are properly balanced. A trial balance is a critical business tool. Trial Balance - Purpose. One of the main objectives of the trial balance is to ensure that the total of. These are the account totals as of the end of the accounting period as compiled from the general ledger. Types of Assets Common types of assets include current non-current physical intangible operating and non-operating. An extended trial balance is a standard trial balance to which are added columns extending to the right and in which are listed the following categories. A company prepares a trial balance periodically usually at the end of every reporting period. Purpose of a Trial Balance To check the arithmetical accuracy of the transactions and the ledger accounts.

A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. A company prepares a trial balance periodically usually at the end of every reporting period. The purpose of a trial balance is to ensure that all entries made into an organizations general ledger are properly balanced. This is the only main purpose of the Trial Balance. At the end of the period the ledgers are closed and then move all of the closing balance items into trial balance. The main purpose of a trial balance is to. The accounts reflected on a trial balance are related to all major accounting. Since it is anyhow prepared for a purpose it is put to some other uses like being used in the preparation of final accounts etc. In Trial balance all the ledger balances are posted either on the debit side or credit side of the statement. An extended trial balance is a standard trial balance to which are added columns extending to the right and in which are listed the following categories.